Posted by Precision Laser & Instrument, Inc. on 25th Oct 2019

Invest Now & Save with Section 179!

Get up to $1,000,000.00* in Tax Deductions on NEW Optical, Laser & GPS Positioning Equipment & Related Technologies!

The Section 179 Tax Code has been renewed by the U.S. government! This gives businesses the opportunity to receive considerable tax benefits on qualifying purchases up to $1,000,000.00*!

Take advantage of this limited-time opportunity to deduct a large portion or all of the purchase price of hardware and software acquired through PLI and put into use by 12/31/19!

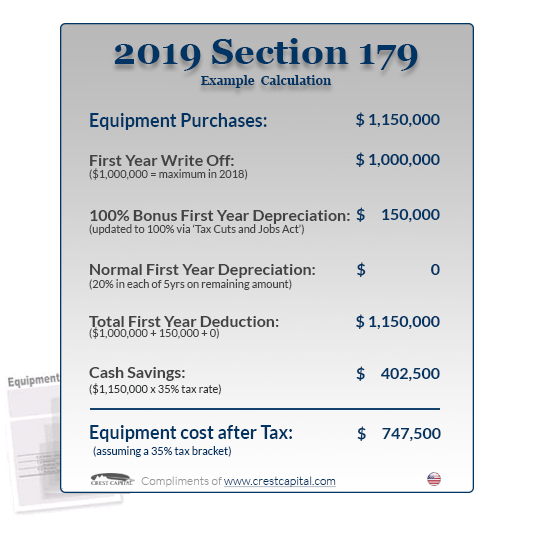

Section 179 at a Glance:

- 2019 Deduction Limit = $1,000,000.00

- 2019 Spending Cap on Equipment Purchases = $2,500,000.00

- Bonus Depreciation = 100%

*Your unique tax situation may have specific limitations or exclusions. Please contact your tax adviser for more information on Section 179. For further information, you can also review the IRS website.